Mortgage Loan Document Checklist

To complete your mortgage application and expedite your approval, the checklist that follows will help you gather the typical documents a loan officer will require.

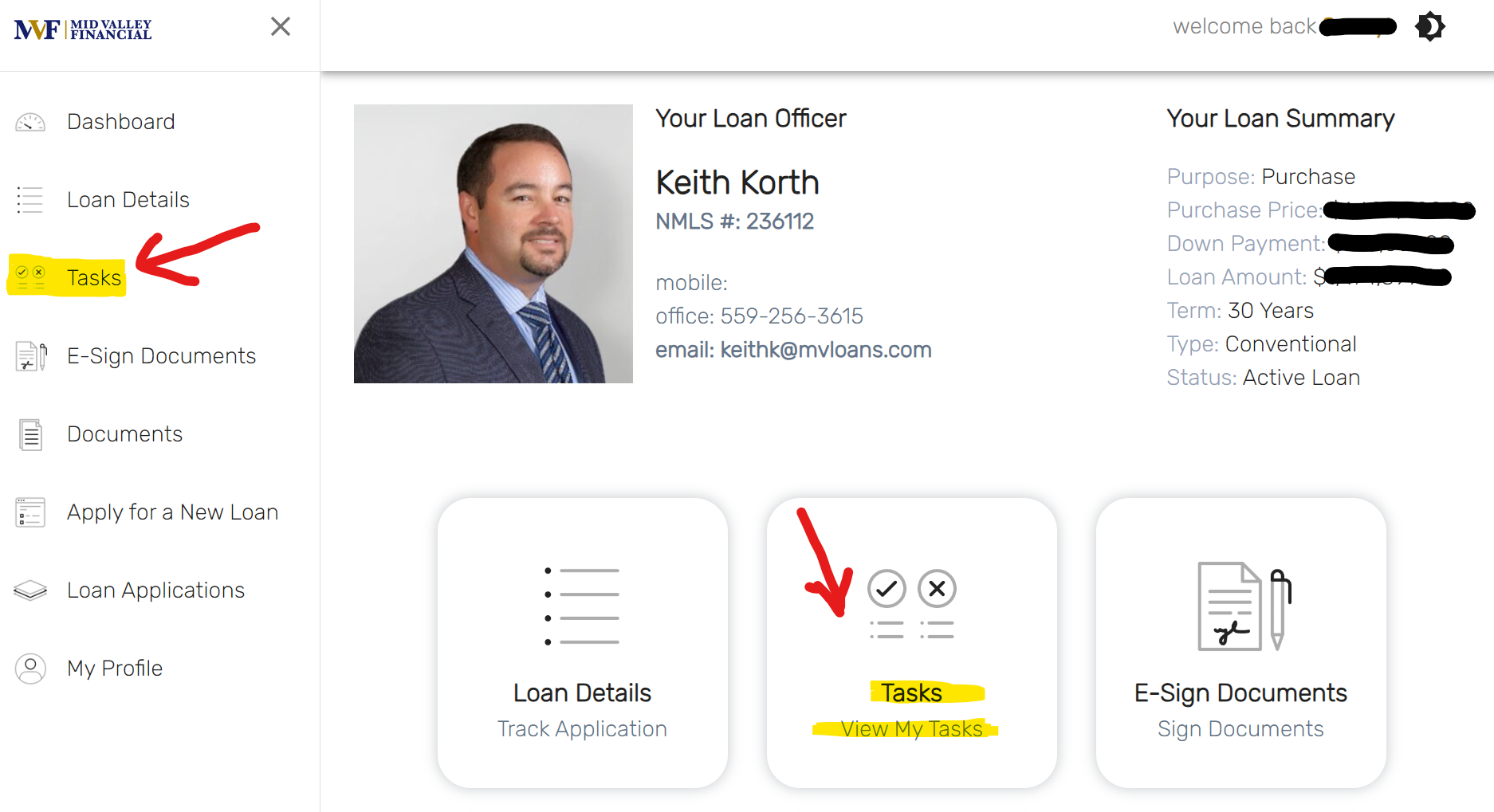

While we offer several easy and secure ways to submit your files, the borrower portal that is created when you start an application is designed to make this process very easy. You can upload PDF documents from your computer or mobile device and when needed you can also use the camera on your device as a scanner to upload pictures of the items you may not have copies of.

While inside your portal, please check the Tasks Folder to ensure that nothing is missing, as the required documents may change based on the type of loan being applied for.

Should you have any questions or need further assistance, we are just a phone call away.

We appreciate you entrusting us to be your guide, as you traverse the world of Real Estate Finance.

The Mid Valley Financial Team,

(559) 432-8221

For all loan applications:

- Paycheck stubs for the last 30 days (or valid proof of current income)

- W-2’s and income tax returns for the last two years

- All pages of your last two month’s bank statements for all checking and savings accounts

- All pages of your most recent investment account statements (stocks, bonds, MM)

- Copies of the most recent monthly or quarterly account statements for any retirement accounts 401(k) plans, mutual fund accounts and/or IRAs

- Copies of a Driver’s License or a State issued ID for all applicants

If you are applying for refinancing, you will need to provide copies of:

- Most recent mortgage statement/bill

- Your homeowner’s insurance company agents name and phone number

- HOA Statement (if applicable)

If you are applying for a VA Loan:

- Copy of form DD214

- Name and contact of your nearest living relative

- Disability information (if applicable)

You may or may not be required to produce one or more of these documents:

- If you have rental property income: A Copy of the current lease agreements

- If self-employed: All pages and schedules of the personal and business Federal tax returns covering the last two years, plus a YTD Profit and Loss statement.

- If you have already made an offer for a home: A Copy of the signed Real Estate Contract

- If you have sold your previous home: A Copy of the Final Closing Statement

- Settlement Statement from sale of the home

- If you pay/receive alimony: A Copy of the full divorce decree or separation agreement, including all pages, schedules, exhibits, and addendums

- If you have ever declared bankruptcy: Copies of all Bankruptcy Discharge papers and a list of the creditors.